Incipia blog

How to Grow Apple Search Ads: The 5 Key Pillars to Scale

In the years since its inaugural launch Apple Search Ads has exhibited a very impressive growth line, enjoying a rise to prominence as a #3 behind Facebook and Google, and in some cases even #2 or #1 status for some iOS advertisers.

For a top-charting app to achieve spend scale of between $100k/month to even $500k/month scale (or more depending on the popularity of the app) with positive ROI on Apple Search Ads is entirely within reason; however, achieving scale on Apple Search Ads is only possible for advertisers who are comfortable to take advantage of all of Apple Search Ad's features. Advertisers who wish to drive massive scale while limiting spend to new users, in the US, with LAT-ON targeting precluded, on non-brand exact match keywords will find that they will be satisfied at lower scale levels, but cannot have their cake and eat it to.

The five features listed below represent five key pillars to unlocking significant additional ROI-positive scale in Apple Search Ads beyond bid increases and keyword expansions with your aforementioned baseline.

Take the LAT Plunge

The first opportunity involves going after users with LAT enabled, which is one of the best opportunities to unlock as much as 40% additional volume in the US or other core markets where LAT usage has been steadily climbing.

These users are generally held to be as valuable as users with LAT-OFF (if not more valuable as inferred from their savviness in locating and turning on LAT), yet many advertisers currently choose to explicitly preclude running ads for users with LAT-ON by turning on demographic targeting in their campaign settings. This means less competition and lower CPTs for those advertisers who do target these users, which all things equal yields a lower CAC/higher ROI for campaigns that acquire LAT-ON users.

The problem is naturally that users with LAT enabled have their post-install data attributed to the organic bucket in MMP reports. So how do you manage reporting for these untrackable conversion events?

The easiest and most popular current methodology is to assess a multiplier based on data from trackable users (i.e. users with LAT-OFF), and to layer this as a conversion rate over the number of installs with LAT-ON. For instance, if your LAT-OFF campaign has a conversion rate to sign up of 20%, this method involves simply apply this 20% sign up conversion rate to users with LAT-ON.

Apple's LAT -ON/OFF columns are provided at all levels of the account hierarchy, from campaign, to ad group and keyword. It's therefore advisable to calculate the multiplier for brand/non-brand, country and match type segments, which would be at either campaign or ad group depending on where they are broken out in your structure. At best the multiplier should be applied to the most granular peer level (i.e. keyword match type).

Two additional considerations cause managing LAT to become more tricky:

The first is relevant in situations where an LAT multiplier is being applied to a conversion that matures over time, such as ROAS. In this case the multiplier will need to be calculated per each cohort period, and the LAT-factored system must keep track of layering the LAT-ON multiplier in each day/week/month cohort, to maintain accuracy in ROAS maturation.

The second, and more thorny consideration is to maintain accurate reporting at the all sources country-level. Because users with LAT-ON are tracked as "organic" users in MMP data, simply assigning LAT-ON installs a multiplier alone is insufficient as this leads to over-counting of conversions.

In order to maintain accurate accounting and avoid double-counting, your reports will need to add an adjustment layer over the organic search segment, and reduce the number of conversions reported from organic by the number re-allocated to your LAT-ON estimations for Apple Search Ads.

Open up to Returning Users

Not only is targeting returning users is one of the easiest ways to acquire additional users, but the potential number of users accessible as a result of can be a very large group to boot, especially for large, established brands. In some cases for large brands (or apps with frequent download/delete usage patterns like dating apps), the number of users can be over 50% of total reachable traffic in the App Store.

For portfolio campaign managers, there is also a handy option to target users of other apps under the developer account.

Apple's returning user targeting does have a couple nuances worth considering:

- There is currently no audience management settings beyond the returning user vs new user vs portfolio user groups, which precludes the ability to exclude users from seeing ads who have, say purchased or used the app in the last 7 days.

- Apple counts users who have ever downloaded an app as a returning user, regardless of whether or not they have the app still installed.

Before turning returning users on be sure to first turn on re-attribution settings in your MMP and integrate this data into your reports, as redownloads will not show up as new installs. Also, be sure to visit the re-attribution settings in your MMP; some MMPs use very long default re-attribution credit settings which you may wish to change.

Beef up on Brand

Since the dawn of search advertising, the question of whether or not to spend money for clicks from people searching your own brand term has been one of contested opinion. With the evolution of digital marketing into ROAS-focused, performance marketing, this question has only become more contested.

So why run brand ads at all?

The only reason to run ads on your brand term is because some percentage of people - and this is the contested number - will choose to either click on the very first result when they search a brand keyword (regardless of whether or not that result is the actual brand result) or else are lured away by a competitor's result.

The problem given this fact is that it's impossible to target brand ads only to the people who would not click on the organic result if it alone were shown, but would click on the brand ad if that were shown in addition to the organic result. The outcome is that some people who would have clicked the organic result if the brand ad was not shown end up clicking on the brand ad because it is shown, which results in a wasted ad click.

The term used to describe the situation when showing a brand ad leads to more downloads overall than an organic result alone is referred to as incrementality. The term that describes a brand ad's consumption of a click that the organic result would have picked up is referred to as cannibalization.

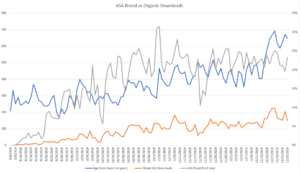

The incrementality/cannibalization percentage is impossible to calculate with 100% certainty, but our research estimates that Apple Search Ads brand ad incrementality is ~40% (i.e. 60% cannibalistic).

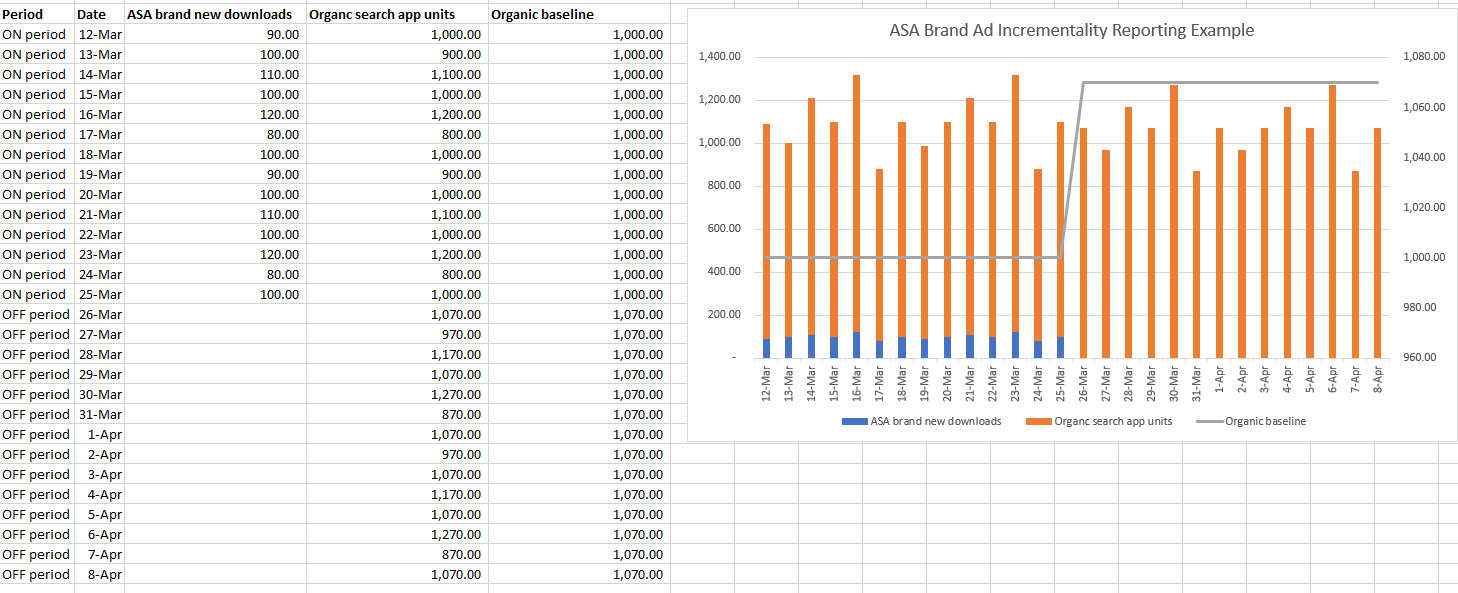

There are several different methodologies that have varying levels of feasibility and expense to estimate the incrementality of brand ads (which is a topic for another blog post), but one of the easiest to do is running an "ON/OFF" study.

This involves establishing a baseline of organic search activity in a given country, turning brand ads off in that country, and then calculating the new organic baseline in the "OFF" period. Subtracting the organic baseline during the "OFF" period from the organic baseline in the prior period gives an estimate of the number of cannibalized downloads. This assumed cannibalized number can then be divided by the baseline number of brand downloads in the "ON" period, which indicates the cannibalization rate (which subtracted from 1 gives the incrementality rate).

For instance, if you see an average of 100 brand ad new downloads in the "ON" period and the organic search app units increase by an average of 70 in the "OFF" period, then the estimated incrementality is 30% (30 of the 100 new downloads paid for were lost once the brand ad disappeared). Be sure to only use new downloads from Apple Search Ads, as these match up with app units from iTunes App Connect, but redownloads are not captured in the app units data point.

Note that this method will likely never be as easy as this sample data set in practice due to the dynamic nature of downloads, but it may be sufficient for a high-level estimate so long as brand is a material share of organic search downloads. More powerful methods such as time series forecasting and regression can increase the accuracy of incrementality measurement.

Go Global

Just as going global is a huge opportunity for organic growth, so too is going global a massive opportunity for apps to capture more downloads in Apple Search Ads. Apple Search Ads has also progressively opened up more countries (though with a few notable exceptions in the BRC countries of Brazil, Russia and China, as well as Turkey), making global expansion a larger and larger opportunity for ASA scale.

Most advertisers are savvy enough to run ads outside of the US in the easy-expand countries of CA/UK/AU/NZ; for one gaming client of ours this generated +38% incremental revenue vs running ads solely for US users.

Expanding beyond these priority countries can produce significant returns as well. For the same gaming client, expanding globally beyond the standard US + easy expand grouping generated an additional +11% in incremental revenue.

Even if your app is limited to English without the possibility to localize and your leadership team has barred you from operating in any region not centered around the English language, take heart as there are still a few easy global wins for you to score incremental growth which you may not have considered beyond the easy-expand CA/UK/AU/NZ country grouping:

- An easy starting point from the US/CA/UK/AU/NZ grouping is to target the other developed English markets of South Africa and Ireland.

- Next up includes targeting high GDP per capita users in the countries with a very high English comprehension rate as a secondary language such as the Netherlands, Sweden, Denmark, Norway, Finland, and Singapore.

- If your goal is to unlock large new scale over high potential ARPU, you can try other countries currently supported through Apple Search Ads which have a large share of primarily English speakers such as India, Pakistan, and the Philippines.

- Lastly, you can target a mix between scale and ARPU with the countries where English as a "de facto" major language such as Malaysia, Israel, United Arab Emirates, Jordan, Qatar, Oman and Kuwait.

One of the most beneficial parts of Apple Search Ads is the de-coupling of creative from the management of advertising campaigns. While frustrating when conducting ad testing, this makes the job of going global quite easy, as the localization heavy lifting happens in the store front, so Search Ads managers aren't required to handle creative localization before going global. Additionally, even in non-English native countries, many searches done in English (or for an app's brand name which is many times not language-dependent) further reducing the effort in testing a global strategy. Lastly, search and broad match can help take on the heavy-lifting of uncovering localized language search term trends with the advantage of CPA data, which can also further reduce the effort to get started globally.

Expand Your Match Types

If you are running exact match only, then one of the lowest hanging fruit opportunities to expand your reach in Apple Search Ads involves testing broad and search match targets.

Precisely just how much incremental scale you can expect in expanding to broad/search match bidding (commonly referred to in joint or separately as a discovery) will mostly depend on how deeply in the funnel you are optimizing for.

If your goal is, say to drive installs or active users, then discovery targeting will immediately improve your overall results. Yet if your goal is to drive ROAS or a certain CAC, discovery targeting may yield a smaller scale within ROI targets.

The reason for worse down-funnel results for discovery is due to the inherent nature of these targets going wide to find users "relevant enough" to your keyword (broad match) or store metadata (search match). The marketing maxim is that when targeting widens users become less relevant, yielding lower ROI on each additional user. Through leveraging the CPA goal, demographic targeting, and consistent grooming of negative keywords, however, you can take discovery to a higher level of ROI even with higher scale.

When expanding discovery, it is crucial to ensure that your brand keywords are added as broad match negatives - not exact match negatives. This is to prevent any possibility of brand searches inflating your broad/search match ROI trends. Given that you won't have visibility into every search term due to the limitations of "low volume search terms," it is not possible to fully know whether brand search terms are slipping in, so it's better to be safe than sorry and invest more into broad/search match on false ROI pretenses. It's also important to negate your bidded exact match keywords to prevent impression-splitting and similarly to better inform ROI-based decisions.

Proactively leveraging broad match negatives to get ahead of trends can help you strike at even higher ROI levels. While you can't see which search terms are locked up in "low volume terms," you can spot trends that can yield more negative coverage using negatives that block searches at the "head" level. For example, if you see a keyword of "free offline games," which is of low relevance to your app, you can add a broad match negative keyword to prevent any other searches involving "offline" such as "offline games," "games for offline play," etc.

For one client of ours in the content vertical, expanding to discovery targeting generated +23% incremental revenue vs global exact match non-brand campaigns.

That’s all for today! Thanks for reading and stay tuned for more posts breaking down mobile marketing concepts.

Be sure to bookmark our blog, sign up to our email newsletter for new post updates and reach out if you're interested in working with us to optimize your app's mobile advertising or ASO strategy.

Incipia is a mobile marketing consultancy that markets apps for companies, with a specialty in mobile growth marketing, analytics & business intelligence, and creative production. For post topics, feedback or business inquiries please contact us, or send an inquiry to [email protected]

Categories

Tags:

- A/B testing

- adjust

- advertising

- adwords

- agile

- analytics

- android development

- app analytics

- app annie

- app development

- app marketing

- app promotion

- app review

- app store

- app store algorithm update

- app store optimization

- app store search ads

- appboy

- apple

- apple search ads

- appsee

- appsflyer

- apptamin

- apptweak

- aso

- aso tools

- attribution

- client management

- coming soon

- design

- development

- facebook ads

- firebase

- google play

- google play algorithm update

- google play aso

- google play console

- google play optimization

- google play store

- google play store aso

- google play store optimization

- google uac

- google universal campaigns

- idfa

- ios

- ios 11

- ios 11 aso

- ios 14

- ios development

- iot

- itunes connect

- limit ad tracking

- ltv

- mobiel marketing

- mobile action

- mobile analytics

- mobile marketing

- monetization

- mvp

- play store

- promoted iap

- promoted in app purchases

- push notifications

- SDKs

- search ads

- SEO

- skadnetwork

- splitmetrics

- startups

- swift

- tiktok

- uac

- universal app campaigns

- universal campaigns

- user retention

- ux

- ux design