Incipia blog

How iOS 14 IDFA Opt-In Will Affect Mobile Advertising

This post is aimed at sharing more perspective on both the strategic and tactical implications of iOS 14 for mobile advertisers.

To learn more about what other people are saying about the iOS 14 IDFA opt-in implications, check out this post with podcasts, Slack groups, posts and documentation from Apple on iOS 14 IDFA opt-out resources.

Massive shout outs to Eric Seufert & Gadi Eliashiv, CEO of Singular for rapidly establishing and spreading credible information & interpretations on this subject.

And if you haven't yet, click here to take our 7-question survey on iOS 14 (we share the current results below).

If you are looking for guidance on how to establish and execute on an iOS 14 plan, contact us or send an email to gabe@incipia.co to inquire about our iOS 14 consulting services.

Let's get into it, starting with the recommendations for advertisers.

What Should You Do?

How should you prepare your iOS reporting?

As of September, prepare to:

- Have your advertising reporting delivered via ad networks, not MMPs.

- Only receive the first ~24 hours after install of ROAS.

- Lose user-level reporting.

- Lose reporting below the campaign level.

SKAdNetwork will deliver install and conversion postbacks directly to ad networks, and not to publishers or other parties like MMPs. So your MMPs will start recording fewer and fewer conversions for users who opt out via tracked channels, and the ad networks will record the proper figures, based on what SKAdNetwork confirms for them. What is unknown is how reporting will work at the ad set/creative level (currently it seems these will report 0 conversion data), and what reporting will look like if you have over 100 campaigns.

Also, SKAdNetwork can provide ROAS at a campaign-level, but with trade-offs after the first 24 hours. By stretching the SKAdNetwork timer and overriding the postback with higher values it is potentially possible to capture ROAS within week one, but there are drawbacks to this as the install is not posted back until the conversion is finalized for 24 hours and the highest value is 64.

SKAdNetwork also does not pass any user-level data, or in fact at current any data below the campaign level. Fingerprinting as a way to retain user-level data is not a viable long-term solution - don't be fooled into relying on it as a crutch for the short-term. Take the bitter pill and spend your energy figuring out how to move forward.

Thankfully for our clients we built a data warehouse three years ago called Xyla which is connected directly to the top five major SAN ad networks (Facebook, Google, Snapchat, Apple Search Ads and TikTok). Because we pull impressions/clicks/spend/installs/conversions/other data directly from ad channels, Incipia/Xyla clients will have no disruption in their reporting come September when SKAdNetwork is rolled out. We're now offering discounts on subscriptions, too! Contact us for more info.

Work with your data & engineering partners to agree on the best way to implement SKAdNetwork.

There are many different ways that your data & engineering partners may choose to implement SKAdNetwork, but this will affect how your campaigns receive data more now than ever before. For instance, if you would like more ability to capture conversion events vs quickly post-back an install, then you will want to work out a way to send the latest highest value event before the 24-hour timer expires, up to 64 days. Or if want to try to optimize for the first 24-hours and quickly inform ad networks that they got an install of value XYZ, then you may want to track new events that occur within the first 24 hours but also pack some value prediction power, and post these events back to your ad networks to optimize against.

Work with your data & engineering partners to start working on a probabilistic incrementality/marketing mix model.

If you are running a significant amount of spend, you will also want to work with your data & engineering teams to plan and start moving towards a probabilistic model for evaluating advertising ROAS. This will enable you to truly assess the uplift on your business beyond the first day of advertising for better decision-making, and furthermore plugs gaps that existed even pre-iOS 14, such as the proliferation of impression attribution and self-attributing networks, limit ad tracking/LAT and organic uplift.

How should you prepare your iOS ad campaigns for September?

Identify and track the events that occur within the first 24 hours that predict high value later on. If the large majority of your ARPU naturally occurs beyond the first 24 hours, then this is a big one for you. You will want to rapidly identify and track these events and post them back to ad networks now to start testing optimization against them. Before September you will want to establish what price you should pay for users who complete these events, whether bidding on those events gives you a positive ROAS, and whether you should make changes, while you still have the ability to see user-level data. You will be able to continue to track some data on users who opt-in, but this is your last chance to get data on most users.

Expect an immediate, significant (20%+) decrease to your iOS advertising ROAS. SKAdNetwork will report an even larger decline than this because it does not account well for revenue beyond the first day. This means you may want to shift budget to your Android campaigns for the time being, and you should re-calculate your acceptable KPI goals.

Strengthen your Apple Search Ads campaigns. Because Apple Search Ads will not suffer from the loss of view-through attribution or algorithmic user-level targeting, confidence in ASA should remain high. It also helps that you can see the actual terms people are searching and assess those for relevance in addition to the reported ROAS/CAC. At Incipia we have been honing our expertise at running ASA campaigns since the day they launched, and have built a bidding automation tool to support our clients. Contact us if you are looking for guidance - we offer consulting and fully managed engagements.

Be prepared for a double whammy to oligarchy advertising. iOS ROAS of Google & Facebook should fall due to A) the loss of user-level data richness in powering machine-learning targeting B) the immediate obsolescence of remarketing and value/ROAS optimization and C) scared advertisers pouring more of their money into Google and Facebook as "safe" bets, pushing up auction prices.

Be prepared to pull back on ad spend in social channels. Social channels such as Facebook, Snapchat and TikTok typically record a very high level of view-through attribution, which is eliminated in iOS 14. So per the point above, not only will targeting falter on these channels, but the reported CPI/CPA will suddenly shoot up as the number of conversions attributed to these channels contracts to click-attributed only.

Decide which of your campaigns/ad sets/ads within each network are really worth running, up to 100 combinations. With only 100 campaigns, many advertisers will be limited to only the top entities across countries, audiences, event/bidding optimizations and ads post-iOS 14. This means you will also need to build out single entity campaigns to get tracking at the sub-campaign level (i.e. single ad campaigns).

Reach out to SDK Ad Networks such as AppLovin, Vungle, Iron Source, and Unity. With the disruption of self-attributing networks, user-level ad targeting and as Apple takes over last-click arbitration, the playing field in ROAS between the SANs and SDK Ad Networks levels.

Pause your remarketing and value/ROAS-optimized campaigns. These are no longer viable post-iOS-14, except for Apple Search Ads campaigns targeting returning users/users of my other apps.

If you monetize via ads, what should you do?

Start trying to figure out how to monetize via IAPs and shift your focus from advertising to organic and referral marketing. Ad-generated ARPU is projected to take a large hit due to the loss of user-level targeting in the ad serving infrastructure, so as your ARPU falls you will A) have less income to invest into advertising and B) have to bid lower for users. Unless you have a healthy flow of inbound organic users and/or can pivot to IAP, September unfortunately spells trouble for you.

Should you keep your MMP?

When your contract renewal comes up with your MMP, keep it, but negotiate.

On iOS, SKAdNetwork is the MMP as of September 2020.

SKAdNetwork data is passed to the ad networks.

Apple has called fingerprinting as user-tracking and the industry opinion is split, but we stand by the opinions of objective leaders like Eric Seufert and Maor Sadra who predict that any loopholes currently open that support fingerprinting will be closed by Apple as soon as they are revealed.

On Android, Google's Firebase will be the MMP within the next year once Google makes its move on the Android advertising ID.

So:

User-level tracking is dead for the future of mobile advertising, and this means big problems and pivots for MMPs.

The value of using an MMP now becomes providing user-level data attribution for the small percentage of users who agree to share their data. If you don't want to build infrastructure to capture this data yourself via Apple's App Tracking Transparency framework, then you will still want an MMP to do so. While it will be a small percentage of users, this data becomes more valuable than gold in the post-iOS 14 world as it can be used to inform your probabilistic models.

What Do we Know About iOS 14 and the IDFA Opt-Out?

Learn more about the mechanics of how SKAdNetwork operates via a post by Incipia CTO Gregory Klein here.

- Apple has disrupted the IDFA (ID for advertising) in order to shake up the advertising industry and crack down on advertising abuse of user privacy. Apple has not touched the IDFV (ID for vendor), which can still be used for user-level analytics/CRM/marketing, but does not connect user behavior with user source; but if the IDFV is abused as the IDFA was, it's possible Apple will take punitive steps there, too.

- Attribution now comes from ad networks who are required to sign up with Apple. Apple signs install authenticity, but does not authenticate conversion events. It's unknown whether Apple will provide an attribution reporting system/API endpoint for publishers.

- When a user installs, a 24-hour conversion timer is started. If no conversion is recorded, the install is posted back to the ad network within a second 24-hour period (at a random 1-24 hour time within that second day time frame). Conversion values can be over-written within the 24 hour timer so long as they are greater than the previous value, and less than or equal to 64. Each time a conversion event is recorded, the 24-hour timer resets.

- There are only 100 campaign parameters per network - there is no mention of ad set or ad parameters.

- SKAdNetwork eliminates view-through attribution, user-level tracking and the ability to run multi-touch attribution models.

- AppTrackingTransparency allows for the collection of the IDFA for users who do opt into data tracking.

- SKAdNetwork will provide a flag for whether a download was a redownload or new download.

- You will only receive the app source ID and conversion value if this meets Apple's "privacy threshold," similar to (low volume search terms) in Apple Search Ads.

- Apple called fingerprinting out specifically as against policy without explicit user consent.

- AEO/CPI optimization possible within 24 hours (or longer with delayed install attribution)

What We're Assuming About iOS 14 and the IDFA Opt-Out?

- ~90% of users will opt out of IDFA tracking.

- Ad targeting returns to contextual-based with declines in efficiency due to:

- Fewer datapoints/length of data trails for ML algorithms

- No user-level data

- Return to contextual targeting

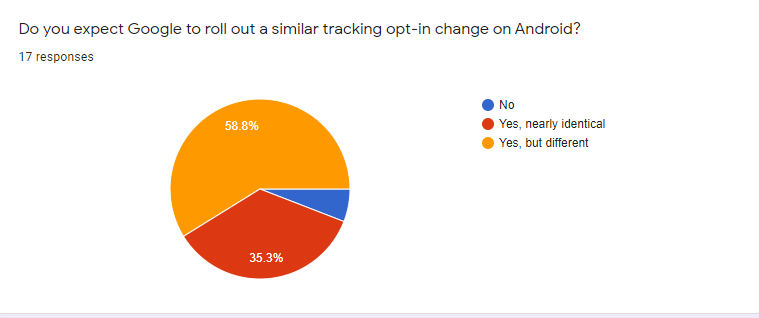

- Google very likely to follow suit.

- Remarketing and Value/ROAS optimization obsoleted.

- Creative and audience testing will be restrained due to the limitation of 100 campaign parameters.

What we Don't Know About iOS 14 and the IDFA Opt-Out?

- What will reporting look like if you have more than 100 campaigns, and at the ad set/creative level?

- How will Apple adjust the framework over time?

- How firmly will Apple enforce fingerprinting abuse?

- Will IDFA gating/UX adjustment lead to store rejections/large churn?

- When will Google roll a change out, and what it will be?

- How much worse ad channel CPI/CPA/ROAS/uplift will be?

- How will conversions will be recorded from Apple Search Ads?

- What will happen to ad-based monetization models?

- How much will mobile advertising spend change by?

What Our Survey Revealed About iOS 14 and the IDFA Opt-Out?

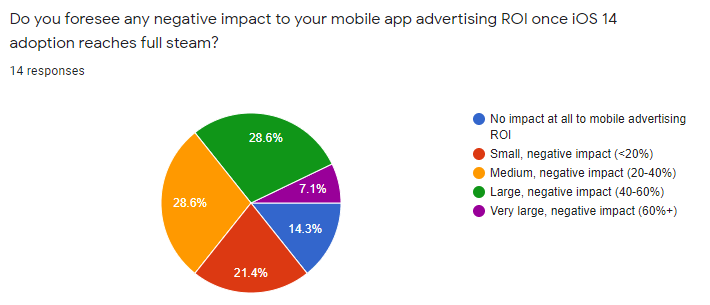

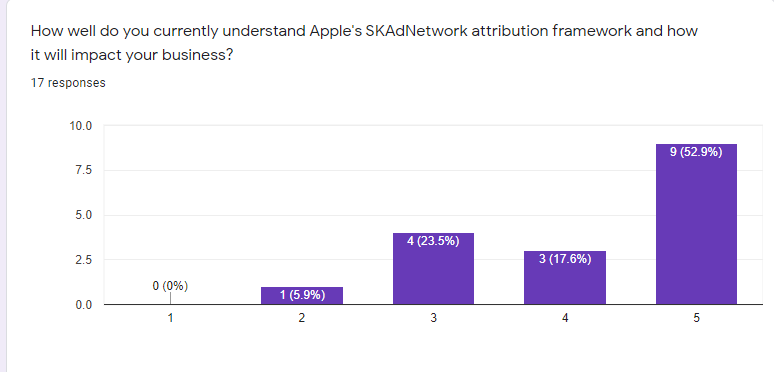

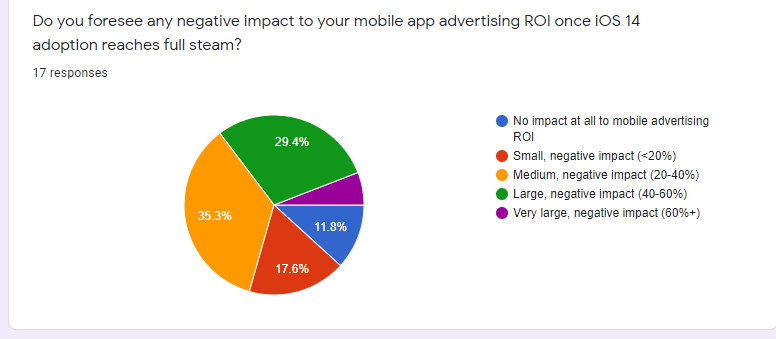

We sent a 7-question out and so far received 14 responses. Take the survey here to contribute to add your voice to the discussion, and we'll update this post with any new insights we receive!

Question #1 revealed a level of hubris from respondents. 47% of people must be lying when they said they knew exactly how these changes will impact their business.

Question #2 was as expected; the impact will not be limited to iOS (94% agree)

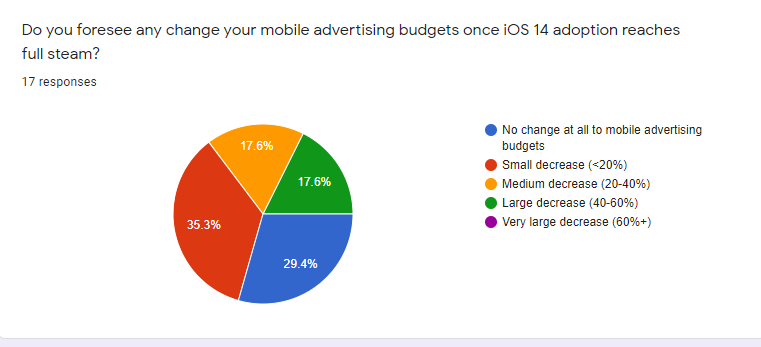

Question #3 was as expected - 88% expect some negative impact; 70% think ROI will decease by 20% or worse; 36% think ROI will fall by 40% or worse

Question #4 was slightly more positive than expected - 65% anticipate a small or no decrease in budgets, but 70% expect a decrease in spend.

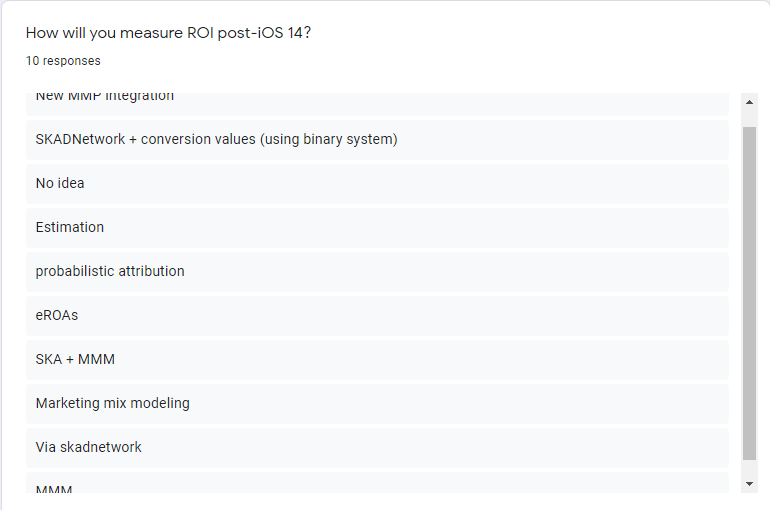

Question #5 was slightly more mixed than anticipated and indicates that it will be complex/probabilistic to prove ROI. 50% of people expect to use probabilistic measurement, while 40% expect to rely on SKAdNetwork.

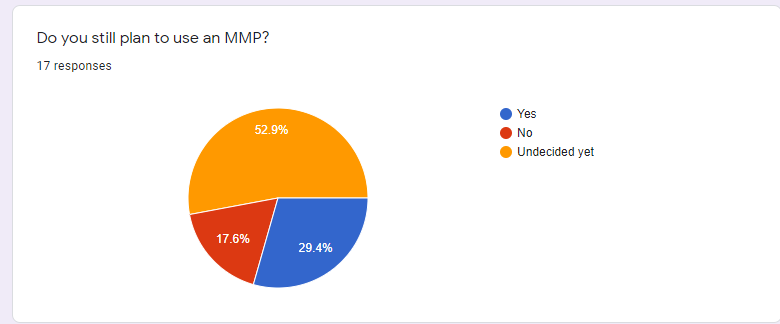

Question #6 was more unknown than expected. The majority will wait and see what happens before deciding on their MMP.

Categories

Tags:

- A/B testing

- adjust

- advertising

- adwords

- agile

- analytics

- android development

- app analytics

- app annie

- app development

- app marketing

- app promotion

- app review

- app store

- app store algorithm update

- app store optimization

- app store search ads

- appboy

- apple

- apple search ads

- appsee

- appsflyer

- apptamin

- apptweak

- aso

- aso tools

- attribution

- client management

- coming soon

- design

- development

- facebook ads

- firebase

- google play

- google play algorithm update

- google play aso

- google play console

- google play optimization

- google play store

- google play store aso

- google play store optimization

- google uac

- google universal campaigns

- idfa

- ios

- ios 11

- ios 11 aso

- ios 14

- ios development

- iot

- itunes connect

- limit ad tracking

- ltv

- mobiel marketing

- mobile action

- mobile analytics

- mobile marketing

- monetization

- mvp

- play store

- promoted iap

- promoted in app purchases

- push notifications

- SDKs

- search ads

- SEO

- skadnetwork

- splitmetrics

- startups

- swift

- tiktok

- uac

- universal app campaigns

- universal campaigns

- user retention

- ux

- ux design